ADVANTOUS CONSULTING, LLC

Sales Tax Voluntary Disclosure

Sales Tax Voluntary Disclosure

Couldn't load pickup availability

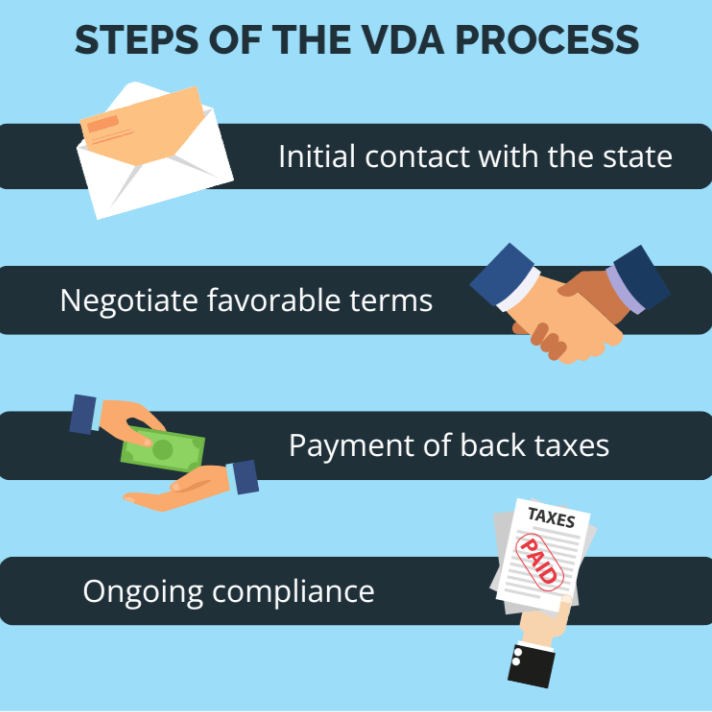

Our Sales Tax Voluntary Disclosure service helps businesses proactively resolve past sales tax liabilities while minimizing penalties. We guide companies through the process of voluntarily coming forward to state tax authorities before being contacted about unpaid taxes. This approach typically allows for penalty abatement and limits the lookback period for tax assessments.

We handle all aspects of the voluntary disclosure process, including evaluating your potential exposure across multiple states, preparing and submitting the necessary documentation, and negotiating with tax authorities on your behalf. Our team has particular experience working with e-commerce businesses, retailers, and service providers who may have unknowingly created sales tax obligations in new jurisdictions.

The service is especially valuable for businesses expanding into new states or those who have recently discovered potential sales tax filing requirements they may have missed. By voluntarily disclosing before being contacted by tax authorities, clients often save substantially on what would otherwise become costly penalty assessments. Pricing for this service begins at $2,500 depending on the number of states involved and complexity of your situation. Contact us to confidentially discuss your specific circumstances.

Share